In Demand Accounts & Finance Jobs :-

Accounts and finance is a wide area. Due to globalization of economy and increased business environment in India, demand for accounting and finance professionals are increasing day by day. Chartered Accountants, Company Secretaries, Cost Accountants, MBAs, Lawyers, Accountants are people who primarily required for various job functions in every industry.

There are many in-demand accounting jobs for individuals with appropriate training. Accounting is one of the top departments in an organization. They’re the professionals who set the pace financially for a company or organization and determine if the organization is meeting their financial goals. The career outlook for accountants continues to be good year after year.

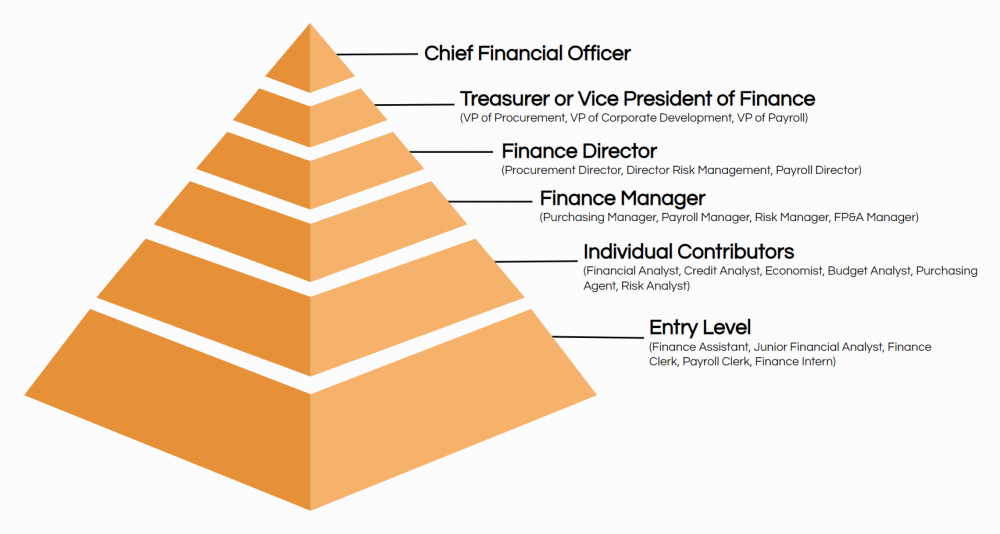

Here are list of some key jobs which are in demand in accounting and finance function.

-

Chief Financial Officer: Chief Financial officer is an officer of a company or organisation that has been assigned the primarily responsibility of managing the company’s finances ,including financial planning , management risk , risk control and financial reporting. A CFO is responsible for a company’s past and present financials situation , and is an integral part of a company’s management and financial future.

-

Finance Controller : Finance Controller is a company’s lead accountant. They look into the accounting activities and look into the creation of internal policies and control to manage those policies. Efficiency and accuracy are important to the financial controller .

-

Audit Manager : A audit manager is responsible for organising and managing all the audit activities of a company as per audit plan. They are responsible for overseeing the process of audit , planning , executing and managing audit assignments and ensuring that organisation fulfils all the statutory compliances. To be a successful audit manager one must have excellent communication skills, knowledge of auditing and strong leadership.

-

Tax Manager : A tax manager plays a critical role in their organisation’s success and growth. The tax manager’s role is primarily to ensure that an organization’s tax strategy complies with local, state and federal tax laws. Tax managers also hold a variety of tax-related responsibilities that work to minimize their organization’s audit risk. Without tax managers, businesses worldwide would struggle to operate.

-

Manager Accounts & finance : He is responsible for day to day book-keeping , accounts payable and receivables payroll, assistance with end-of-month close, grant reporting, audit preparation, and other related duties as assigned.

-

Accounts Executive : An account executive is an employee who has the primary day-to-day responsibility for an ongoing business relationship with a client. He is responsible for day to day accounting entry in tally and other accounting software as preferred , preparation of debtors /creditors list , bank reconciliation , Gst reconciliation. He is also responsible for preparation of financial statements , MIS and other required detail as may be required by the management.